Related Links

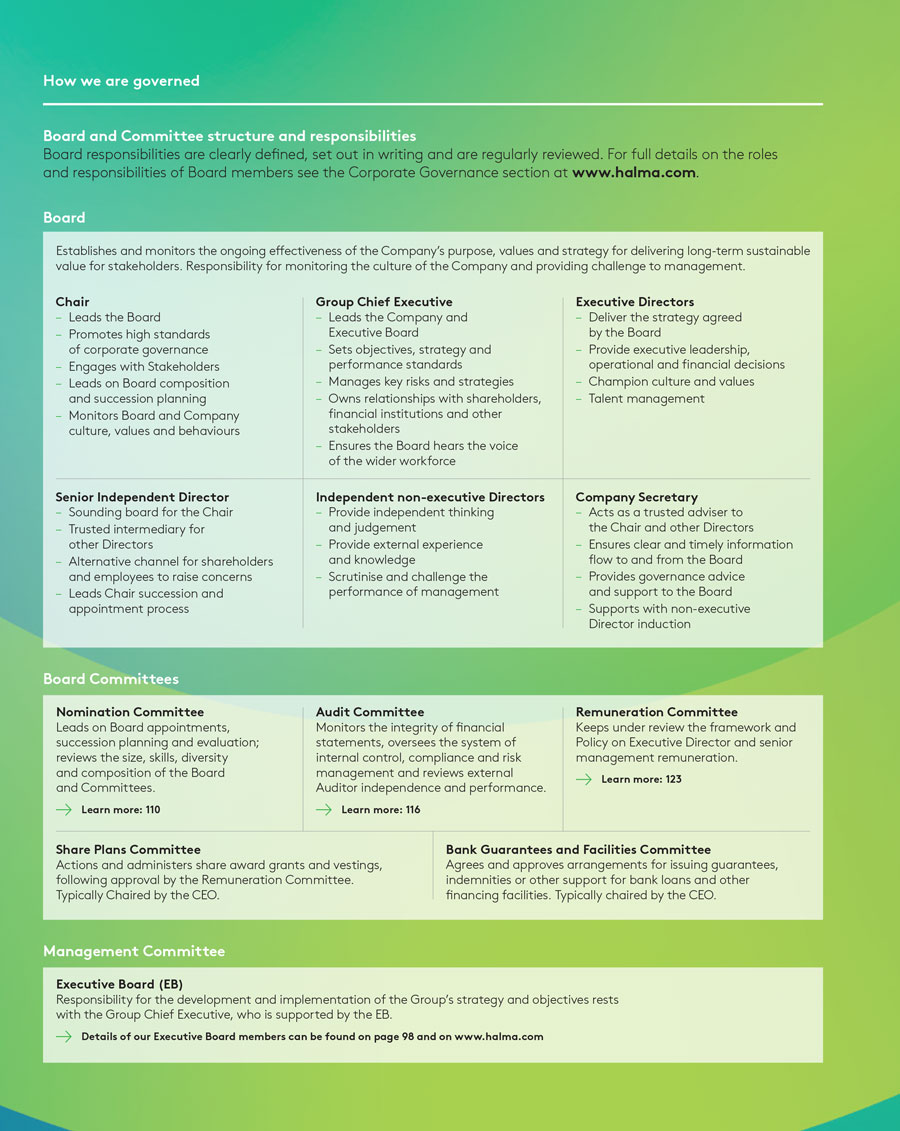

The role of the Board is to provide entrepreneurial leadership, within a framework of prudent and effective controls, that promotes the interests of Halma over the long term for the benefit of stakeholders. The Board sets the Group’s strategic goals and has ultimate responsibility for its management, direction and performance. The Company’s Articles of Association set out the Board’s powers. The Board has adopted a formal schedule of matters reserved solely for its decision and certain decision-making and monitoring activities have been delegated to Board Committees or management, through a clearly defined delegated authority matrix.

The Board has established three principal Committees – Audit Committee, Nomination Committee, Remuneration Committee – which review and monitor key areas on behalf of the Board and make recommendations for its approval. Each Board Committee operates under written terms of reference which are approved by the Board and made available at www.halma.com. The Chair of each Committee reports to the Board on their activities after each meeting and minutes are circulated to all Board members once they have been approved by the Committee. Further information on the activities and composition of each Committee is detailed in each of the Committee reports.

View the Remuneration Committee's Terms of Reference

View the Audit Committee's Terms of Reference

View the Nomination Committee's Terms of Reference

View the Share Plans Committee's Terms of Reference

View the Articles of Association

- Setting the Group’s long-term objectives and commercial strategy.

- Approving annual operating and capital expenditure budgets.

- Ceasing all or a material part of the Group’s business.

- Significantly extending the Group’s activities into new business or geographic areas.

- Changing the share capital or corporate structure of the Company.

- Changing the Group’s management and control structure.

- Approving half year and full year results and reports.

- Approving dividend policy and the declaration of dividends.

- Approving significant changes to accounting policies.

- Approving key policies.

- Approving risk management procedures and policies, including anti-bribery and corruption.

- Approving major investments, disposals, capital projects or contracts (including bank borrowings and debt facilities).

- Approving guarantees and material indemnities (not otherwise delegated to the Bank Guarantees and Facilities Committee).

- Approving resolutions to be put to the AGM and documents or circulars to be sent to shareholders.

- Approving changes to the Board structure, size or its composition (following the recommendation of the Nomination Committee).

- Assessing and monitoring the Group’s culture and alignment with its purpose, values and strategy.

Halma is committed to building a diverse and inclusive culture throughout the Group. Diversity, Equity and Inclusion is one of our Key Sustainability Objectives as we believe it benefits the global economy and creates a fairer future for everyone, every day.

The benefits of diversity across all levels of the organisation are clear and the unique culture that each of our businesses bring – through innate differences in our people – is the foundation for our success. Creating inclusive environments, where everyone has equal access, opportunity and treatment and can bring their full self to work, is fundamental to accelerating our growth and achieving our purpose.

The Board has agreed the following commitments, which are in line with the FTSE Women Leaders Review recommendations and go beyond the targets recommended by the Parker Review

- to maintain gender balance at Board and Executive Board level by ensuring that representation of both men and women is at or above a minimum 40% threshold and, by 31 December 2025, ensure a minimum representation of men or women one-level below the Executive Board is at or above the 40% threshold;

- to have at least one woman in the Chair or Senior Independent Director role and/or one woman in the CEO or CFO role;

- to maintain at least two ethnically diverse Directors on the Board;

- to have at least 20% of senior management positions (defined as the Executive Board and their direct reports, excluding administration staff) occupied by ethnically diverse executives by December 2027; and as a signatory to Change The Race Ratio, we commit to increase racial and ethnic diversity at senior leadership level, to be transparent on targets and actions, and to create an inclusive culture in which talent from all backgrounds can thrive.

Approved by the Board of Halma plc on 6 June 2024